One of the side effects of the coronavirus outbreak, it sadly seems, is the increase in the number of divorce enquiries flooding into solicitors since the current lockdown began. The pressure of being at home 24/7 in what could have been an already tempestuous relationship, is clearly taking its toll, with searches for “I want a divorce” on Google soaring by 154%. Home schooling children, financial worries and a huge change in lifestyle are all pushing some households a step too far.

High net worth individuals, who may have stayed in unhappy situations due to expected financial losses are seeing assets reduce. They are therefore taking advantage of businesses or shares dropping in value – albeit temporarily – and hoping to push through a financial settlement in what could be seen as an opportune moment.

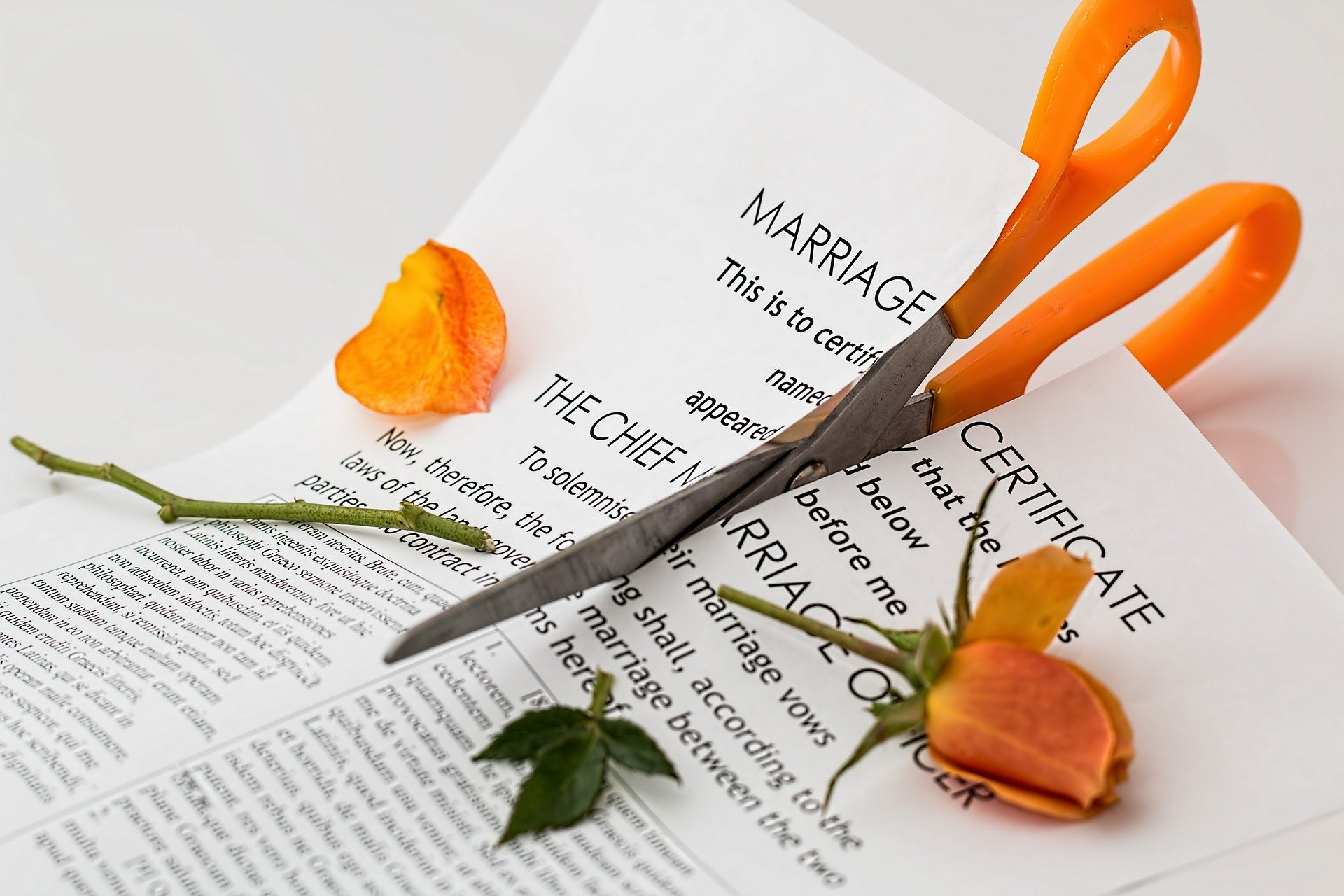

Going through a divorce at any time can be a traumatic experience, even if both parties are relatively amicable. If tensions are high however, especially around the matter of money, it can spiral into a very distressing time where one or both parties may feel it necessary to “give in” to demands, in order to simply move on.

In recent years, more and more couples have chosen to use mediation as a method to agree and finalise both custody of children and financial agreements. Going to court can, in many ways, end up being combative, let alone expensive, but a professional mediator is both impartial and trained to steer a couple through this emotional upheaval. Nevertheless, they are not professionally qualified to give financial advice, nor are family lawyers, who often become an individual’s lifeline during this process.

Dividing up financial assets can be complicated, depending on the length of the marriage and complexity of a couple’s financial situation. There could be multiple pensions, ownership of shares or businesses, as well as joint investments that are often put into the lower tax payer’s name, but were destined to be used jointly in later life. Retirement funds can be one of a couple’s most valuable assets, as well as the matrimonial home and additional properties that were purchased during the marriage.

It could be argued that in the past women were perceived to have benefited more from divorce settlements, especially if they had given up a career to look after children, with a spouse who was earning enough for a single income household. Today though, the law dictates all assets are jointly combined, with the split starting at 50:50; negotiations then continue according to individual circumstances.

Although both the courts and mediators will always strive for a fair settlement, it is important for both spouses to recognise what it means by walking away from certain assets. If they are close to retirement, their future earning potential can be a lot lower, so it becomes harder to start rebuilding a pension pot. If joint savings or savings from the Bank of Mum & Dad have been pooled to buy property, then how will this impact proceeds from the sale of the home – and the list goes on. It’s also critical to highlight that people don’t need to be in the high net worth bracket to seek the advice of a financial adviser. A simple conversation could be all it takes to give some much needed peace of mind, or enable a spouse to approach the situation with facts and figures that will assist them in making the right decision. A financial adviser will usually work closely with family solicitors to provide individuals with a solid professional team behind them, to offer both support and direction in their qualifying fields.

These lockdown restrictions will lift eventually, and a new normality will ensue. It is hoped that many couples will weather this storm and come out stronger the other side, but as we do not know how and when offices will reopen and face to face meetings can begin again, online conversations can still be arranged and assistance can be provided immediately. Divorce is a long-term outcome with implications that can reach much further than anticipated. Don’t make a snap decision that seems right at the time, that you may regret in years to come.

If you need to speak, in confidence, to any of our financial advisers, we are here Monday-Friday to help.

https://www.mediate.com/articles/murphey-healthy-break-up.cfm